There’s a lot of help on offer for startup and early stage businesses (by my reckoning, a few hundred opportunities in the South West alone), but alas no accurate directory or smart way to apply, which seems odd as it‘s the sole purpose of these schemes to help entrepreneurs establish and grow their precious babies.

Unsurprisingly, after a few fruitless hours most startup founders file it all away in a box marked ‘waste of time’ and get on with something more fun and productive. Messy real world 1: Ambitious start-up 0.

Here’s some welcome news, finding and applying for helpful stuff can be done with a few insider tips – and that’s my aim in this series of guest posts.

In this opener we’ll get a helicopter view of the options – a no nonsense primer on how to navigate the startup funding world. In the follow-ups we’ll get into the nitty gritty of how to identify the best grant opportunities and practical tips and tricks for getting the application pain down and the chances of success up. Each post will be liberally peppered with links to grants and other support opportunities.

When we’re done you should be able to make sound risk:reward judgments whenever you come across a new start-up grant, funding or business support opportunity.

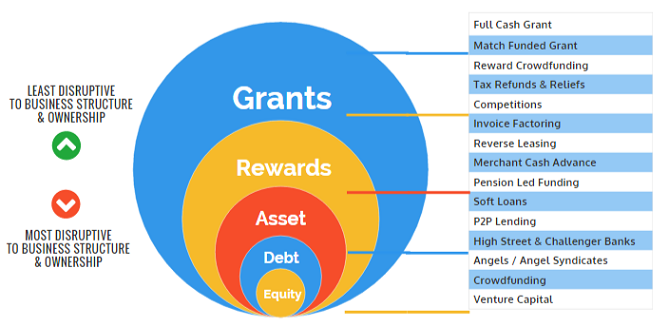

Sidebar, Funding Using The GRADE Framework

This infographic shows broadly the options to get external cash into a business. Those higher in the list tend to be less disruptive, those towards the bottom should be considered thoroughly as they affect who owns the business and therefore how decisions are made.

A logical way to progress is to start at the top and work down – this framework applies to all businesses and not all options will be appropriate for a startups.

Startup Help Comes in 2 Flavours: ‘Funding’ and ‘Other’

Most startups focus on funding, but what they actually want is what that money can get them. That end goal may be available via other schemes, initiatives or approaches, so it really pays to think creatively around the issue first.

Rather than charge full on into a grant or other funding application, really question why you need it and explore if you can ‘hack’ an alternative. There is a whole other realm of support for startups which is not covered in this post: getting advice, increasing sales, developing people or products, building personal networks or your business’s infrastructure.

Grants

A genie pops out of a lamp and hands you £50k. That would be nice, but its highly unlikely.

Typically, the larger the grant the more difficult it is to get, the more people will be after it, the more onerous the conditions, and – in the vast majority of cases – you’ll have to put in money too. Matching the grant pound for pound is common.

There are various grant making organisations and we’ll explore them and their agendas in depth in the next post. Briefly, it’s either public funds from local, national or EU level (or a mixture), or from socially-minded funders which may be relevant if your business also delivers an additional social or economic benefit – there are a fair few ‘tech for good’ opportunities knocking about.

(Publically funded grant example: South West Growth Fund

Social grant example: Social Tech Seed).

Before you run for the hills wailing in disappointment, you may find that city, local or county councils run ad hoc small grant schemes for startups (in the low thousands or hundreds) and on occasion you’ll not have to stump up a ‘match’. Due to the lower amounts involved these are much easier to secure and although competitive, if you are on your toes you’ll stand a good chance. Track down the economic development officer at your council(s) to see what’s on offer.

(Local grant example: LEADER, North Devon).

We’ll deal with grants in depth in the follow-up article, for now let’s look at the alternatives to help get your startup financed.

Rewards

In this pot sits an odd collection of opportunities. The one common feature? Being successful is partly down to luck and your particular circumstances.

The Tax System

The taxman has spent a few centuries concocting a fantastically complicated system. Perhaps so he can tip the scales in his favour? Who knows. Buried in this forest are a couple of opportunities I’ll highlight (there are many more but discussing tax for too long has been known to kill).

The first is applicable to very many tech business: research and development tax credits (often abbreviated to R&D credits). It can get very complicated, but as a rule of thumb, if you are a limited company you may get up to ⅓ of your R&D expenditure back from the taxman in cash. Woo-hoo! My advice is to use a reputable tax agent to suffer the admin pain, deal with the taxman and most importantly maximise the result while ensuring there are no red flags for HMRC’s compliance pit bulls to get excited about. Even though this money is a refund (rather than available upfront) it is well-worth investigating and planning for in your cash-flow.

(R&D Tax Credit advice at the .gov site

Or from a no win no fee specialist agent forrestbrown.co.uk).

The other tax opportunity is applicable if your business is not yet making money and you are working on it full-time. Often overlooked, but bloody handy: child tax credit and, to a lesser extent, working tax credit. Again the devil is in the detail, but as an example if you’ve a couple of kids, you’re working full time on your start-up and your (life) partner is working say part-time in an employed role, you may be due £300-£500 a month. Not ‘Vegas’ money, but a crucial contribution in the very early stages for some.

(Check your eligibility and award for tax credits at the .gov site. Check for tax credits and other benefits at Turn2Us).

Competitions

The startup scene has some great competitions and some terrible ones too. These are run by a whole host of organisations and for various reasons. Corporate sponsors want to align themselves with the wholesome free spirit of entrepreneurialism and have some nice PR, media competitions are mainly for promotion but rarely have any hard cash offered, and then there are those competitions which are used as the method to distribute really significant levels of funding and support. Even the government has got in on the game and runs various ‘tech challenges’ and innovation vouchers.

(Government competition example: Digital Innovation In The Sharing Economy

Corporate sponsored competition example: Shell LiveWire Smarter Future

Publicity competition example: Growing Business Awards).

These are well worth considering. At the very least you’ll get some PR and good networking opportunities. If you win, there is often hard cash and/or a support package of free software, hosting or advice. Usually a damn good buffett too at the awards do too.

Rewards Crowdfunding

Now here’s a fact that may spill the coffee. Modern day rewards crowdfunding was innovated by… the British rock band Marillion, who in 1997 funded their US tour of the USA by pre-selling tickets direct to US fans. The idea quietly grew in the arts and culture space and then exploded with the help of Indiegogo and Kickstarter.

Rewards crowdfunding is quickly evolving and growing and, for certain types of startup is well worth considering. Quite simply your supporters (investors) pledge money to receive a reward, most often the product or service you are intending to develop and bring to market. It’s a great way to test an early concept and raise funds, although the amounts tend to be fairly low, the average successful raise is a little under £4,000 (from The UK Alternative Finance Report 2014, Nesta & University of Cambridge 2014). The downside is, it’s crowded (pun most definitely intended) and finding and mobilising supporters to pledge enough to get you up and running is pretty much a full-time job in itself. That said there are a raft of platforms that do the heavy lifting and plenty of services springing up to help make your campaign successful.

(The major global rewards crowdfunding sites: Indiegogo, Kickstarter

Popular UK sites: Crowdfunder, FundSurfer

Crowdfunding platform selectors: CrowdingIn, The Crowd Funding Centre).

Asset

This is going to be a pretty thin selection as it rarely applies to startups. The approach of this style of funding is to release cash from assets and by definition, a startup is unlikely to have much in that column of the balance sheet. Here’s a few marginal cases which may be relevant to some…

Cash Advance

If you are making regular sales by credit or debit card you can borrow against and pay back via future card payments. This is not cheap finance and without 6 months + trading records may not be open at all.

(Popular UK merchant cash advance providers: Liberis, Capify).

Factoring/Invoice Discounting

Again relevant if you are making sales, in this case large invoices to blue-chip clients. There are some great online providers who assess the credit risk of your invoice(s) and lend against them. For growing startups with enterprise clients, this is definitely one to consider

(Popular UK factoring providers: Platform Black, Market Invoice).

Pension Led Funding

If you are a silver fox entrepreneur with a decent sized pension pot (£50k+) there are some schemes which can release some for that cash. Fairly complex and pricey to arrange.

(Popular UK pension led funding provider: Pension Led Funding).

Debt

If you are running an early stage start-up you may be surprised to hear that there are some debt funding options which do not guarantee you’ll lose your first born child or be paying pole-vault high interest. Indeed there is quite a market for soft-loans which are underwritten by public funds or social lenders. These may be easier to get and less demanding to pay back, but do not be mistaken [switch to deep booming voice] – debt should should never to be taken on lightly, and there are always negative consequences if you default.

The options below are from formal lenders who cater for startups. I have not included informal sources: friends, family and fools, not the thousands of options for more established businesses, nor the option of taking out personal debt.

The Government

Start Up Loans is the government’s flagship startup finance product. It’s been running since 2012 and has lent nearly £200m, backing 35,000 startups and offers up to £10,000 per applicant. The loans are distributed by ‘delivery partners’ who check you and your business over, help put a business plan together and hold your hand if needed. This is good value debt finance at 6% p.a., it’s unsecured and there are no other fees, and if you have co-founders there is nothing stopping each of you applying.

The considerable downside is this is lent to you personally, so if your startup doesn’t get past starting up, you’ll be liable to repay and it all goes on your credit record. Considering all startups are high-risk, without security it will be difficult, expensive or impossible to get a mainstream bank to lend to you, so this is worth investigating.

(The official Start Up Loan site: startuploans.co.uk)

Social Lenders

There are a nice group of lenders who sail under the banner of ‘responsible finance’. They can step in where mainstream lenders have said no. The terms will typically be more commercial than the government’s startup loan, but rarely too scary. In some cases, you’ll be able to borrow significantly more than £10k. The motivation of these lenders is to help you and many are run as social enterprises or not-for-profit.

(Responsible Finance official directory of lenders: findingfinance.org.uk)

Sector-Specialist

Occasionally a bright spark at the Treasury crunches some numbers and forecasts if money was made available to a particular sector lots of jobs would be created and oodles of lovely tax paid back the government in the form of VAT, payroll and corporation tax. And with a wave of the hand a great big dollop of cash is helicopter dropped onto the lucky industry. A recent relevant example would be creative, digital and games sectors. There have been a flurry of finance schemes offering grants and subsidised loans

(Grants and Soft Loans for creative, digital and games sectors: UK Games Fund, Creative Industry Finance, Creative England Interest Free Loans).

Equity

Now we are really playing with fire. You are going to give up a share of ownership in your fledgling business in exchange for funding – yikes. There are significant implications so [again switches to booming voice] – get advice before treading this path to cover off all the tax, legal and compliance issues.

Before taking a whistle stop tour through the equity funding options available to startups, I would make special mention of a great short course run by SetSquared, the world’s no1 business incubator which is available across the South. If you are luckily enough to get on (it’s free if you’ve a great technical startup idea) you’ll be forced to assess your startup from the perspective of an investor. All equity investors are looking for at least a 5x-10x return on their money back within 5 years or so – and of course the bragging rights of backing a winner.

Let’s look through the startup equity menu…

Angels & Syndicates

These are single or groups of investors, investing their own money. This is an ever popular option now representing £1 billion of annual investment into UK early stage businesses each year (from Nation Of Angels, UK Business Angel Association, January 2015).

When it works well, you’ll be getting the funding and the ‘value add’ of an angel’s knowledge, contact book and the possibility of follow-on investment. How much a single or group of angels can invest of course varies but this is typically not for idea stage startups, unless you have something pretty phenomenal. Whether or not you are successful raising money from angels, by doing the rounds of the angel circuit you will get excellent advice and feedback from very canny people who have often built up a tech business of their own.

(UK Business Angel Association,

Online angel platforms: Angels Den, Angel Investment Network, Syndicate Room

Popular UK angel syndicates: Surrey 100 Club, London Business Angels).

Accelerators

These programmes have really taken-off of late. Fixed programme length and content, say 3-6 months, generally includes office space and support, mentoring and training in exchange for seed investment, varies by around £30k-50k for a share in your business.

There are now dozens of accelerators, more and more operating in a niche: edtech, fintech, cowtech, you name it. Large corporates are running them too, essentially as a pseudo innovation / R&D department or for a bit of PR. In the majority of cases you’ll need to base yourself in programme for the duration. You’ll get to learn from your peers in the programme cohort too, so if your startup doesn’t fly perhaps you can join one that does!

(Global directory of startup accelerators: F6S

Corporate sponsored UK accelerator (free): Entrepreneurial Spark).

Crowdfunding

I’ve lumped friends and family in with crowdfunding as many entrepreneurs opt to use these platforms to take care of the admin and paperwork – something that is absolutely necessary and can be overlooked when dealing with people you know. You can also ‘line up’ those investors you know personally to invest at key points during your crowdfunding campaign.

Average successful raises for equity crowdfunding are around £200k, but expect 3-6 months of very hard work to pull it off. You will need a compelling proposition, combining a defensible market position, crack team, validation in the form or sales or pre-sales; so this is often more appropriate to later stage startups. There is a wealth of advice and services to help make your campaign a success.

(Popular UK equity crowdfunding platforms: Seedrs and Crowdcube).

Wrapping Up

What’s common to these various start-up funding options? There are many many more startups looking to raise funds than there is money available, so capital is distributed to those with the best prospects. And that is as it should be. So if you are not having much luck perhaps your idea is not yet as great as you think it is.

Luckily you can avoid the pitfalls, wasted time and dead-ends but simply not bothering to raise any funding (yet) and instead use bootstrapping and lean start-up tricks to test and hone your business model, product and team.

The take away: raise money to grow a business not to find out if you have a business.

About the author

Mike Oaten is the founder of Busy Chief, who help businesses find and apply for grants, funding and business support. You can connect with him on Linkedin or contact him at mike@busychief.com.