Hugh Karp is the founder of Nexus Mutual, a startup that uses the power of blockchain technology and Ethereum to allow people from all over the world to share insurance risk together without the need for an insurance company.

We caught up with Hugh to chat about his journey into the blockchain space, the history of mutuals, the rise of insurance companies and why he believes blockchain can solve the problem of scaling trust.

Discovering Bitcoin and Ethereum

Hugh has been an insurance professional for over 15 years and took an interest in Bitcoin in the early days of its conception. “I actually left a bunch of Bitcoins on an exchange that got hacked and so lost the vast majority of them. It wasn’t very much at the time but it was a fantastic learning experience, because all of a sudden I had to work out what a private key was and all those sorts of things” he says.

After a few years and having lost interest Hugh returned back to blockchain technologies and stumbled across Ethereum and the idea of smart contracts. “If we can write a small programme and a simple ‘IF THEN’ statement then surely that can work as an insurance contract” he tells us.

A history of mutuals

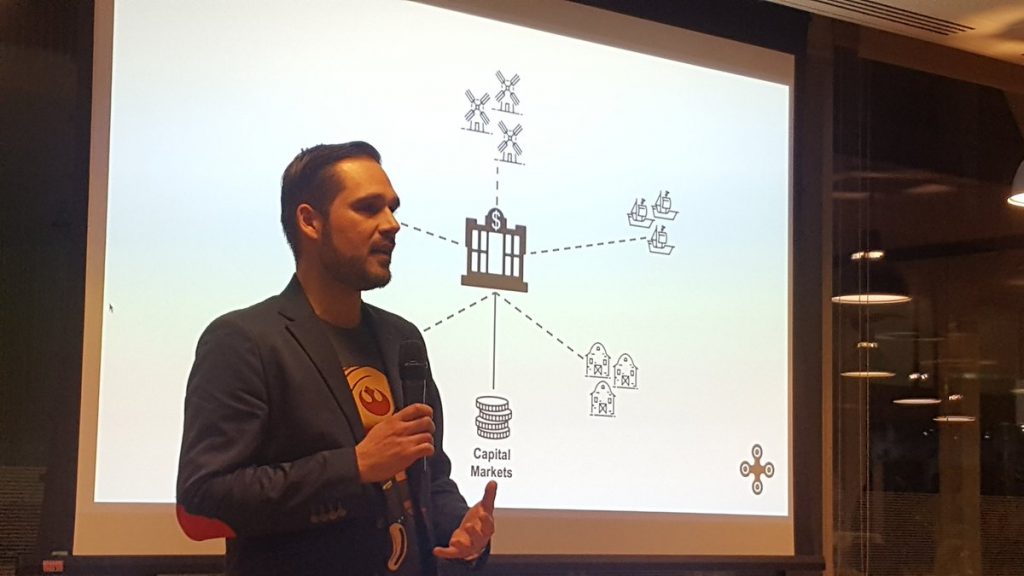

It was Hugh’s exploration into using Ethereum for insurance contracts that led him to learn more about the history of the early mutuals and how, before insurance companies existed, communities would group together themselves. “In essence they just kind of come together and make decisions on claims themselves and if there’s not enough money in the pot then there’s not enough money in the pot” he adds.

Over time, mutuals largely disappeared because they couldn’t trust or always agree with other towns or villages over the hill meaning they couldn’t scale trust. “That’s why 100 years ago we moved away from that model and put in place insurance companies to bridge trust between different village groups or certain groups of people” Hugh tells us.

Other problem mutuals struggled with included having enough capital to back the insurance contracts. As Hugh explains: “If only ten people have £100 each then you’ve only got £1000 to spread, but the loss of someone crashing their car could be more than £1000, so you can’t ever cover that and end up needing more and more people in the fund.”

Hugh also chatted about the idea of de-mutualisation that became popular in the early 90’s. “In the early 90’s we saw a large number of mutuals turn into shareholder companies so they could essentially turn their capital into shares and trade them. So there was all this pressure on the mutual to disappear” he says.

Scaling trust using blockchain

Hugh believes that blockchain technology can solve the issues faced by the early mutuals. “You couldn’t scale trust before but blockchain can step in and allow people to trust the code instead” he explains.

Hugh tells us how trust can be scaled by recording transactions on a shared ledger. This allows the members of the mutual to trust each other without knowing one another, allowing the community to expand, unlike the early examples of where early mutuals found it hard to trust other people from different towns or villages.

To solve the access to enough capital to back contracts Hugh talks of ‘Tokenising’ the entity behind the mutual. “By making something tradable that wasn’t tradable before you can access external capital” he says.

Hugh believes we have a chance to go back to the old model of insurance. “Essentially by using blockchain technology, our premise is that you can solve the two scale issues of the mutual and bring them back into the old model of insurance that we used to have” he said.

The voting mechanic

Hugh talks about how Nexus Mutual will provide a ‘human’ safety layer, or voting mechanic, to minimise the risk of bugs being found in contracts and reduce attacks such as the Parity Multi-Sig wallet attack. “We’re putting a human layer across the code, so when it comes to claims the members will vote on if there’s a claim or not.”

Hugh sees the DAO hack as an example of where having a human layer as a safety net, if the code doesn’t operate as it was intended, as a good thing. “With the DAO hack, you could argue that the code is law or not, but it was clearly against the intention of the code that someone should run off with all the money and funds” Hugh says. “With smart contract cover it’s very hard to write an algorithm on whether the intention of that code was met or not. But humans can make that judgement call” he said.

Providing incentives through tokens

Hugh believes there is a need to provide an incentive for external security and contract assessors to check over the smart insurance contracts. He explains: “When you need external work from the outside world and want to bring it onto the blockchain, you need to provide an incentive. Bitcoin mining does that with external proof of work and computing power. With Nexus we need similar mechanics.”

To do this, external assessors will be incentivised through the use of tokens. “These will be provided to security auditors and people with those types of skills to assess contracts. If an external assessor makes the wrong decision they can lose money on that stake, if not then they get extra tokens when they make a sale on that contract” Hugh adds.

A different token approach

Nexus Mutual is currently in private funding and they plan on crowdfunding the insurance funds – ‘risk pool’ – when they launch at the end of 2018. Hugh tells us: “We’re going to launch with a live product, so effectively that is going to open it up to a membership base for people to put in money and funds, effectively funding the risk pool that backs the contracts.”

Their approach is different than most Initial Coin Offerings, whereby you raise the capital first and then build the platform. “We’re saying here’s a live product and any money will back the contracts rather than the development team. It will sit in a decentralised autonomous organisation (DAO) effectively and you get tokens at that point” he says.

The future of Nexus Mutual

When it comes to the future for Nexus Mutual, Hugh tells us: “Our big lofty goal is to become an alternative risk carrier for the insurance industry. We have to start in a niche and grow from there. And so we’re picking a niche that is close to the Ethereum community.” Hugh is continuing to work on Nexus Mutual and aims to have a live release towards the end of 2018.

Find out more about Nexus Mutual at nexusmutual.io and for full technical details you can read their whitepaper. You can also follow Hugh on Twitter for the latest updates on Nexus Mutual.

If you’d like to discuss your startup or project, get in touch with Simpleweb today.