Gavin Eddy is a former investment banker who decided to pack up and leave London in 2007 and move to the South-West, where he founded the shared workspace company Forward Space. Simpleweb is currently working with Forward Space on Coherent, a new app to help workspace operators manage their space, as well as encouraging workers to connect, network and collaborate.

A former investor of organic grocer Fresh and Wild (who were later acquired by Wholefoods) and a large tea and coffee company, Gavin has invested in companies working in a number of industries from emulsion paint to a bike building school and currently a sleeping pods company who’ll soon be opening their first hotel in Gatwick airport.

Gavin had studied at Bristol University and decided to move back to the South-West after leaving the banking industry

“I decided I was going to move back to the South West and focus on investing in startups and early stage businesses. I’d done some investing before that, when I was working in the city, but had decided when I gave up I would focus on it full time.”

On changing his plan

Although Gavin still holds a number of investments and continues to invest in early stage businesses, founding Forward Space was not exactly his original plan.

“The intention was to buy a building and find companies that I wanted to invest in. Then I was going to co-locate them all in the building making them easier to manage and provide resources, support, advice and mentoring So it was in effect an incubator.That was how I envisaged it.

“But it didn’t really work out like that, because I guess I didn’t really think about the geography. It’s not like London where you’ve got this incredibly high concentration of people and a startup on every street corner, and they’re all desperate to live and work in Shoreditch. The South-West is much larger and the startups are a bit more spread out. I suddenly realised I was talking to all these companies asking if they would want to relocate but they were quite happy being in [for example], Southampton, and didn’t really want to move to Bath or Frome!”

The idea wasn’t a complete waste, however, as it did help Gavin to realise the need for co-working spaces in the area.

“I was meeting lots of small companies and in talking to them realised that once you got outside of London, there was a real shortage of high quality workspaces that were aimed specifically at startups and small businesses. Around 2005, I’d been to visit a workhub called The Hub in Islington and I realised that model could be just as applicable to places outside of London that have an entrepreneurial cluster or startup culture , and so I thought that’s what I would do. My idea went from being an incubator for my companies to a model for shared workspace for startups and early stage small businesses.”

On separating from a business partner

For a short time, Gavin worked with a business partner who’d been involved with large workspace complexes in London. But it didn’t work out and the pair separated on less than good terms.

“When I first moved here he [the business partner] was also relocating from London. He had a house here already and was at a similar life point to me, in his early 30s and thinking about settling down… I think we were similar in the sense that we were both looking to create workspaces aimed at entrepreneurial people like ourselves who were moving out of London.

“He just didn’t turn out to be quite what he purported. Really he was a property developer and I’m not that interested in just creating properties to flog off. What I’m interested in is building a supportive network of startups. I think we realised that we were on a different journey. I’m in it for the long haul, I’m in in because I’m really interested in what goes on in those buildings. Yes it’s great to own beautiful buildings, but I care about what happens inside them with the people and the businesses.”

Gavin says eventually it all came to a head over money “as things often do” and the pair separated.

“I felt like a bit of a fool. I guess it’s kind of like being in a relationship with someone and waking up one morning only to realise they’re not at all who they made out to be, You feel like an idiot.”

When asked about what advice he’d give people who are in the process of, or considering, separating from a business partner, Gavin laughs and says “revenge is a dish best served cold.” It’s clear he’s joking and after considering for a few seconds, he warns against getting resentful.

“I think the knee jerk is to get angry or to doubt yourself, but you don’t really have time for that. It mustn’t become a distraction from what you were originally trying to do. I wasted about two years getting my business back on track… and I’ll never get those 2 years back. My advice would be to brush yourself down, pick yourself up and forget about it. Move on as quickly as you can, because if you’re standing still you’re really going backwards. You’ve got to keep on task and not become distracted, which I definitely did.”

On choosing who to invest in

Like a lot of investors, Gavin focuses on areas where he has experience.

“I see a lot of ideas but I tend to gravitate towards things I understand. Perhaps because I came from finance I gravitated towards real products – things that you could actually touch. My first investment was in food and drink, and so initially I started with that.”

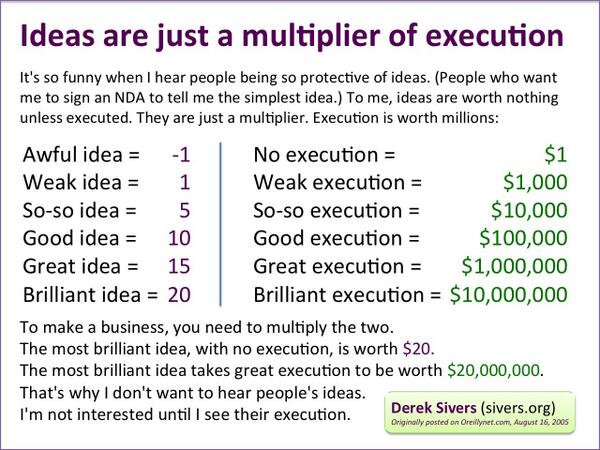

Gavin says he doesn’t really believe in good ideas but more in timing and execution. By way of explanation he shares the following diagram to explain how the value of a business is a combination of how good the idea is and how well it’s executed.

“I started off thinking that it was all about the idea, but as I invested more and more, I realised that the idea is only a very small element of the success of a business. Now I’m not sure that I really believe in good ideas. What I believe in is good execution. You want to find someone who takes that idea and does it really, really well and in my experience that’s usually about the people. They just see something that other people don’t see, or they think in a way that other people don’t think, or they’re almost obsessive about what they do. So now when people ask me what I look for I tell them I place a lot more emphasis on the people than the idea.”

Although he’s not going to invest in any ideas he doesn’t believe in, Gavin does stay in touch with people he likes.

“I’ve certainly met people where the first idea they’ve pitched to me I’ve absolutely hated. I’m brutally honest so I’ll usually just say this is not something I think is investable but I think you are so if you ever come up with anything else… The sleeping pods guy, the first idea that he pitched to me was something I completely hated, but I really liked him. I said for reference I don’t think this idea is going to work, but if you do something else, then come back and talk to me. The first idea didn’t work out, but he came back and talked to me about a second idea.”

That’s not to say that Gavin hasn’t previously invested in someone he didn’t particularly like, although he’s the first to admit he regrets it.

“I absolutely loved the product, it was fantastic, a real market disruptor, but I didn’t like the founder at all. I still invested in the company, probably to my regret. We fell out big time and in the end there was a bit of a boardroom coup and I kicked him out of the company. It was very distracting, he was obstructive and very difficult to work with and in the end the only way to move forward was to oust him from his own company. It isn’t something I’d want to repeat.”

On building great relationships with your investors

Communication is key to building valuable relationships with your investors says Gavin.

“Communicating clearly with your investors and making sure you manage their expectations right from the get go, I think is really important. Meet with them regularly, be honest with them, be transparent with them, make sure that they really understand right at the beginning what your vision is and where you want to go.”

On finding the right investors for your business

Don’t just take investment from anyone who’ll give you the cash, warns Gavin. Make sure they really understand and believe in your goals and have more to offer than just money…

“If they have even the tiniest bit of doubt …then don’t go with them, because investors that are not behind you 100% can be very time consuming. You’ve got to know that they absolutely understand what it is that you’re doing, where you’re going, what sort of timescale it’s going to take for you to get there.

“Managing investor expectations on timescales is essential. Tech culture by its nature is fast paced but there’s this idea that people make millions overnight. What I know from investing is that it’s a much slower burn that you think it’s going to be. If you think you’re going to make a return in 3 years, it’ll be 5, if you think it’ll be 7 years, it’ll be 10. I think particularly with unsophisticated investors or first time investors make sure you are managing expectations accurately from the beginning. It will make your life easier in the long run.

“What you should really focus on is what else you can get out of them other than just money because you can get money from lots of places… Do they have connections in the industry? Can they open doors for you with particular people? Are they an existing player in that sector? It’s all about what else they can bring other than the money. Especially because although it doesn’t feel like it at the time, equity will be the most expensive money you will raise, so make sure you get good value for it. There’s no question that your business can move a lot faster if you’ve got people that can open certain doors for you so really look at who they are and who they’re connected to and how you can use that.”

Having too many investors, however, is something Gavin advises against.

“Just be wary of having too many investors. Crowdfunding is fantastic and I think [it] has absolutely transformed the way that startups and small businesses raise capital. But I think managing relationships with hundreds of investors can be time-consuming and distracting.

“What you want to do when your business is getting started, is focus on executing the business really well. If you’re spending all your time communicating with your investors you’re not working on your business. Make sure that you work with the smallest group that you possibly can and communicate with them clearly.”

On great startup advice

Gavin has an interesting piece of advice for entrepreneurs that he still follows himself.

“The best bit of of advice I was ever given was to have an FU number. An FU number is an amount of money that, the day you have achieved it you say “FU – I’m off!” My boss said to me, when I first started working in banking, if you let it this industry will just suck you in and then spit you out at the end of your career and you’ll just wonder what happened to you. He said you’ve got to be in control of the situation, you’ve got to go in to it knowing what you want to get out of it. The way I apply this to investment or as advice to entrepreneurs is plan how and when you will exit before you’ve even started.

“I think the secret to a happy life is to know what your FU number is and then to get out immediately when you’ve made it and go and do something else… That’s really what prompted me to leave banking and to come and do what I do now. I still set targets for what I want to make out of all the companies that I invest in, and at the point I hit that target I say okay right, this is time for me to exit now and do something else. And it’s the same with my own business now… I have a number in mind.One day we’ll hit that number and I’ll do something else.

“I quite like the idea that you get to reinvent yourself. Every 7-10 years you get to give up and do something completely different. Starting all over again keeps you fresh, keeps you interesting.

The idea of reinventing yourself is something Gavin feels strongly about.

“I think reinventing yourself is really important. The concept of a job for life just doesn’t exist anymore, so why not then have 4, 5,6 jobs and make the most of the opportunity to learn new things..

“I’d never been a technology investor and so Coherent is the first project I’ve ever invested in that’s technology driven. I’ve done it now because it’s a soft entry point in that it’s linked to a business that I already own, so I’m not going into it completely cold. We understand the sector and we’ve got a great technology partner in Simpleweb. I’m not saying I’m going to become a tech investor overnight but its definitely something I’m really interested in now. Maybe Coherent will prove to be the beginning of my next reinvention!“

We’ll keep you up to date about Coherent here but if it sounds interesting to you, head over to their website and sign up for early access.

If you’d like to discuss your startup or project, get in touch with Simpleweb today.